We’re rapidly evolving our platform, so you have the tools and information you need to provide superior advice to your clients.

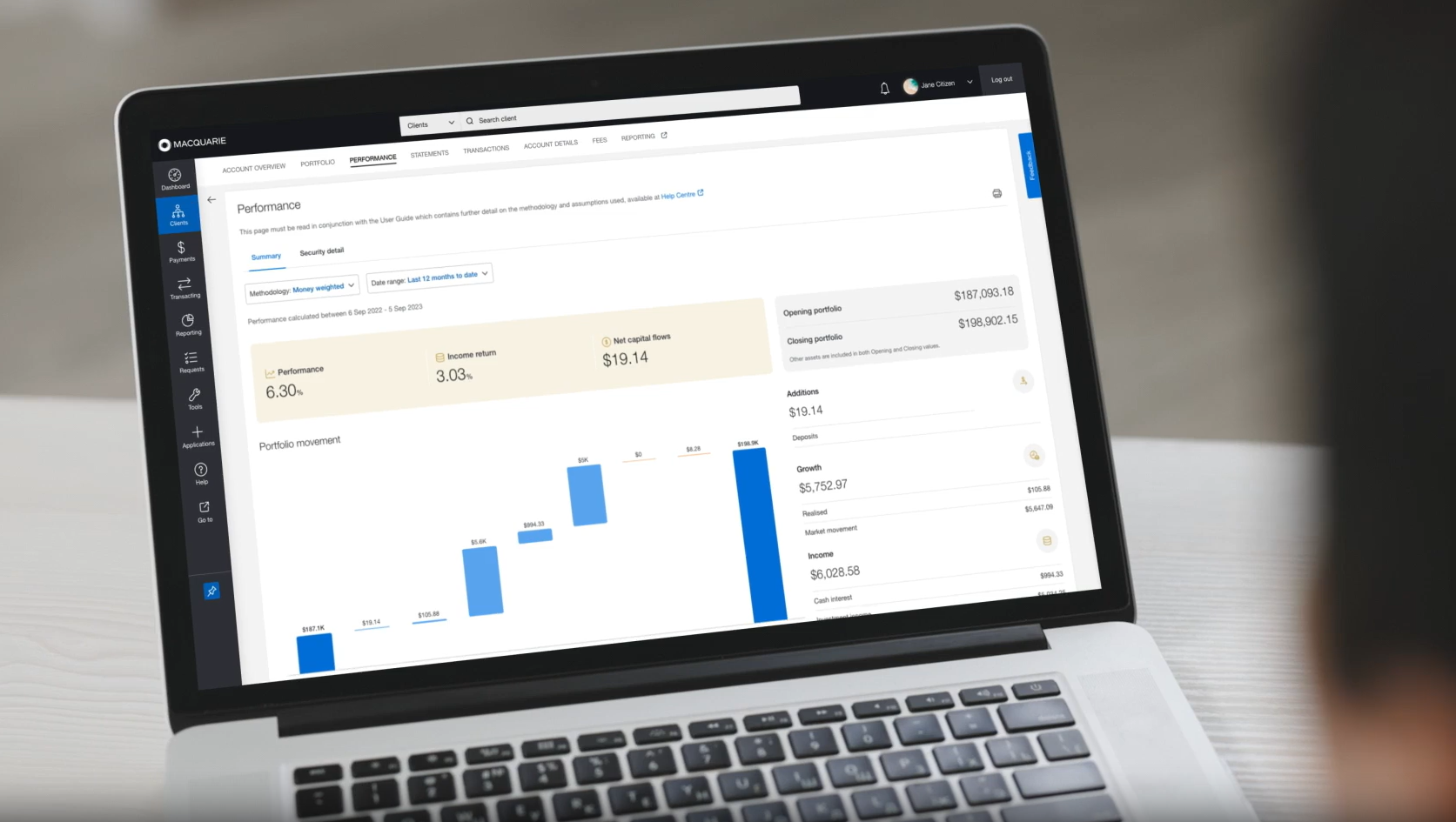

Our latest release of account-level performance reporting in Adviser Online is built to give you confidence. With visibility over your clients’ investment performance, leveraging tailored insights and data, you can have control in your next client meeting and deliver insightful recommendations against their investment strategy.

This is just one of many features we’re excited to have released in September. Read the Digital Download below to find out more on our latest platform enhancements and updates.

Michelle Weber

Head of Wrap Platform

Monthly feature: Access insights and data to make smart investment recommendations and provide superior advice to your clients

We’re building a suite of outstanding reporting tools in Adviser Online, ensuring you have access to your client’s information and reporting from one location.

Most recently, we’ve added account-level performance reporting which gives you:

- quick insights with headline statistics

- visual portfolio movement with our dynamic waterfall graph

- streamlined access to our helpful user guide.

As part of our account-level performance reporting, we’re also releasing our Security Detail screen which allows you to:

- customise your view

- easily see top movers by growth and performance,

- quickly click through to see underlying performance of securities held within an SMA.

We're transitioning to Adviser Online gradually, rebuilding and enhancing the reporting capabilities that you enjoy before we remove it from Wrap Online.

This means for now, you can continue to use the tools you’re familiar with in Wrap Online, but we encourage you to start accessing them in Adviser Online, where the reporting experience of the future is being built.

Watch the video below to learn more about our performance reporting focus and how we’re building a digital experience that’s easy to use, every day.

Watch Video

Loading video...

Enhancements and updates

Helping you manage your clients’ Macquarie Wrap accounts

- Simplifying the way fees are calculated

Flat-dollar fees will no longer change month to month. Clients on existing annualised flat dollar fees will convert to an equivalent monthly amount, and an adjustment may be applied in October to account for any rounding difference. - Making it faster for you to obtain consent and deduct advice fee

Soon you’ll be able to manage fee groups via Adviser Online, add an account to a group using our online forms and use our online Advice Fee Form to add, renew and remove advice fees that calculate on a fee group or account balance. - Improving our forms for a more streamlined experience

On 7 October, we’re releasing an updated Application Form, Advice Fee Form and Switch Form. Any forms created prior to 8 October 2023 should be submitted to us for processing by 31 October 2023. From 1 November, older versions of the forms won’t be accepted.

Improving your online tools and experience

- Track and report on your clients’ portfolios’ market exposure with Asset Allocation Benchmarking in Adviser Online

As part of migrating tools from Wrap Online into Adviser Online, we’re enhancing the existing Asset Allocation tile on the 'Account Overview’ screen in Adviser Online. This means you'll soon be able to customise your clients’ Asset Allocation benchmarks and assess historical asset class exposure to align with the clients’ specific investment goals in Adviser Online. This allows you to benefit from improved usability, toggle between pie and bar charts, and generate uplifted client friendly Asset Allocation reports that will support end of year conversations.

Give your clients quick access to their income with Account Income Redirection in Adviser Online

Now available in Adviser Online for Wrap users with transact access, Account Income Redirection gives you the ability to redirect investment income (dividends, distributions, interest) from a Macquarie Wrap account to an external nominated account (rather than to a linked CMA), integrated with Authenticator for adviser approval. Read more in our Help Centre article 'Account Income Redirection'.

- Quick and easy access to Asset Transfer information via Help Centre

We’re streamlining the ways you can access Asset Transfer information to ensure you have a single source of truth. This means we’ve removed the Asset Transfer Wizard, as you can quickly and easily find this information via our Help Centre article ‘Requirements to transfer assets in or out of my client’s Macquarie Wrap account’. - Helping you better manage your clients’ accounts with our new Payees and Billers screen in Adviser Online

Our new ‘payments’ screen is live, helping you manage payees and billers associated with a cash account without having to initiate a payment. You can access this page by navigating into your clients’ cash account and selecting ‘Payments’ as shown in the image below.

- Multi-market trading now offered via ASX or CBOE

All orders for Australian listed securities placed via Adviser Online will be executed on ASX or CBOE. We’ll take reasonable steps to obtain the best outcome for the client, in line with the MEL Best Execution Policy. Assets exclusive to CBOE are not currently available on the Macquarie Wrap investment menu. - A safer, quicker and more convenient way for your clients to bank

We’re transitioning to completely digital payments and as part of this, between January 2024 and November 2024, we’re phasing out our cash and cheque services across all our banking and wealth management products, including super and pension accounts. To ensure you’re prepared to help your clients with this change, please read our Help Centre article ‘It’s time to make and receive payments digitally’, which we’ve created to help you and your clients access key information and resources about this change and digital payments. - Giving you more options to submit documents to us digitally

We’ve recently added PleaseSign and SigniFlow to our list of approved E-Signature providers. When using PleaseSign and SigniFlow, please ensure documents:- contain the authoriser’s electronic signature

- are accompanied by an electronic signature provider's issued Certificate of Completion which has detailed information relating to a signer’s digital identity and document activity. It can be downloaded as a PDF and needs to come from your email address, or your client’s, along with the authoriser’s electronic signature to go ahead with your instructions.

- are sent by email from the authoriser’s email (your client’s registered email) or from an email address from your office. You can also upload it via Request Centre.

- A more personalised banking experience for your clients

Our new notification feature enables clients to set a threshold limit, meaning they'll only be notified when a transaction is made over the amount they’ve set. This online and mobile banking feature allows our clients to enjoy a more personalised experience when banking with us. - Easier visibility and access to find the accounts you’re searching for in Adviser Online

We've improved the product dropdown filter and grouped (nested) the products into Cash, Investment, Super and Pension.

Helping you protect yourself and your clients from fraud and cyber threats

As fraud and cyber-crime techniques evolve, it is important to stay informed on how to best protect yourself and your clients.

Earlier this month, Laura Khoury, Macquarie Bank’s Digital Fraud Detection and Analytics Manager and Lucy Barton, Macquarie Bank’s Cyber Culture and Outreach Lead, hosted an insightful and practical webinar designed to help raise your awareness on scam prevention and cyber security, so you can better protect yourself and your clients from fraud and cyber threats.

Watch The Evolution of Fraud webinar here

Giving you more choice and flexibility

We added new assets listed below to our Macquarie Wrap investment menus effective 1 September 2023. Read our Macquarie Wrap Investment Menu update for more information.

New Separately Managed Accounts (SMAS) | |

SMAATT10S | Atticus Core Balanced |

SMAATT11S | Atticus Core Growth |

SMAATT12S | Atticus Balanced |

SMAATT13S | Atticus Income Defensive |

SMAATT14S | Atticus Growth |

SMAATT15S | Atticus High Growth |

SMAATT16S | Atticus Balanced Index Plus |

SMAATT17S | Atticus Growth Index Plus |

New Managed Funds | |

SSB6649AU | ClearBridge RARE Infrastructure Income Fund – Unhedged Class A units |

ETL5010AU | Coolabah Floating-Rate High Yield Fund (Managed Fund) Assisted Investor Class |

GTU1669AU | Invesco Credit Opportunities 2023 Fund (IM)* |

ETL6156AU | MFS Global New Discovery Trust |

ETL0535AU | Nanuk New World Fund (Managed Fund) AUD Currency Hedged |

JBW0103AU | Yarra Global Small Companies Fund |

ECL2707AU | Ellerston JAADE Au Priv Assts Fd (Ret)** |

Exchange Traded Products | |

IMLC | IML Conc Aus Shares Fund (Quoted MF) |

MCGG | Munro Concentrated Global Growth (Managed Fund) |

N100 | Global X US 100 ETF |

HCRD | BetaShare Interest Rate Hedge Aus Corporate Bond ETF |

* IDPS only

**Access to this investment for Super and Pension is restricted to clients of the relevant adviser or dealer.