You can find information about our interest rates on the following pages:

- Transaction Accounts

- Savings Accounts (including welcome rates)

- Business Savings Accounts

- Cash Management Accounts

- Cash Management Accelerator Accounts

- Wrap cash hubs

Already have a Macquarie account?

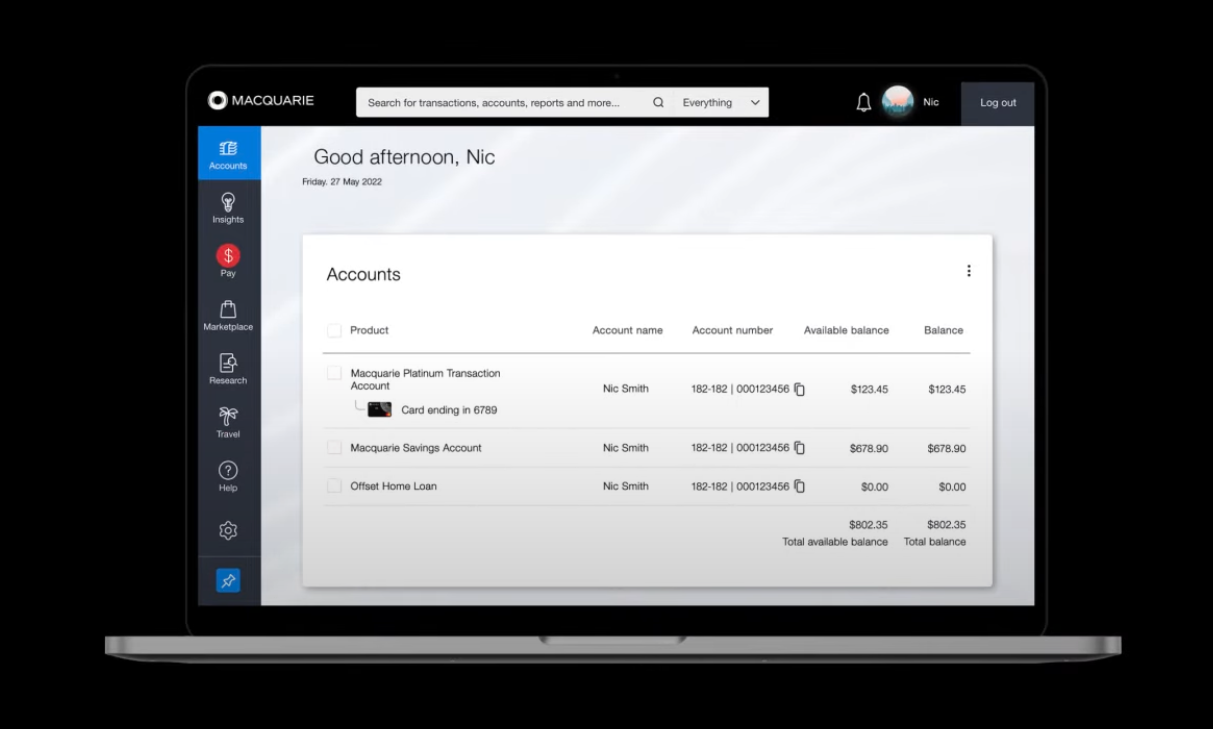

To view your interest rate information on the Macquarie Mobile Banking app or Macquarie Online Banking:

- Log in to your account

- Select your account from the account list

- Select the I want to button

- Select View account and interest details in the menu

- All interest rate details including your interest rate and total interest earned is listed under the Interest details section.

Watch now

Loading video...