This year, we’ve released a significant number of new features and enhanced tools and hope you’ve enjoyed the benefits of:

- greater support via Adviser Online with the release of live chat

- enhanced protection of your business and clients’ financial information with multi-factor authentication

- access to insights and data to make smart investment recommendations and provide superior advice to your clients

- relevant and insightful information from our enhanced Adviser Online dashboard

- quick access to your clients’ correspondence online

- greater visibility of adviser and dealer details with My access in Adviser Online

- access to all your clients’ information and reporting in one place via Adviser Online.

As we move into the new year, we’re focused on delivering more benefits for you and your staff. Read our December Digital Download for a Wrap-up on our 2023 deliveries and keep an eye out for our next edition in February 2024 with more.

We want to thank you for your partnership and wish you a happy and safe festive season.

Michelle Weber

Head of Wrap Platform

What we’ve delivered this year

- Greater support via Adviser Online with the release of live chat

We enabled the capability for you to speak directly with a Macquarie Wealth consultant via our live chat feature in Adviser Online. Now available between 8:00am and 7:00pm (Sydney time) Monday to Friday (excluding national public holidays and banking holidays), you can access live chat via the pop-up box located in the bottom right-hand corner (shown in the image below). As you’re already interacting with us in a secure environment, there’s no need to go through the same identification process as over the phone. If we're unable to resolve your issue over chat, the consultant you're chatting with will call you promptly. This means you don’t have to wait in a phone queue and complete a full ID verification.

- Protecting your business and your clients’ financial information with multi-factor authentication

In August, we introduced multi-factor authentication into Adviser Online as part of an important security uplift. In a further step to protect you and your clients, we’ve recently made the Macquarie Authenticator app the sole verification tool you can use within Adviser Online. This means you’re using our most secure, digital verification and transaction approval tool to keep you, your clients and your business safe from potential fraud and scams.

Watch video

Loading video...

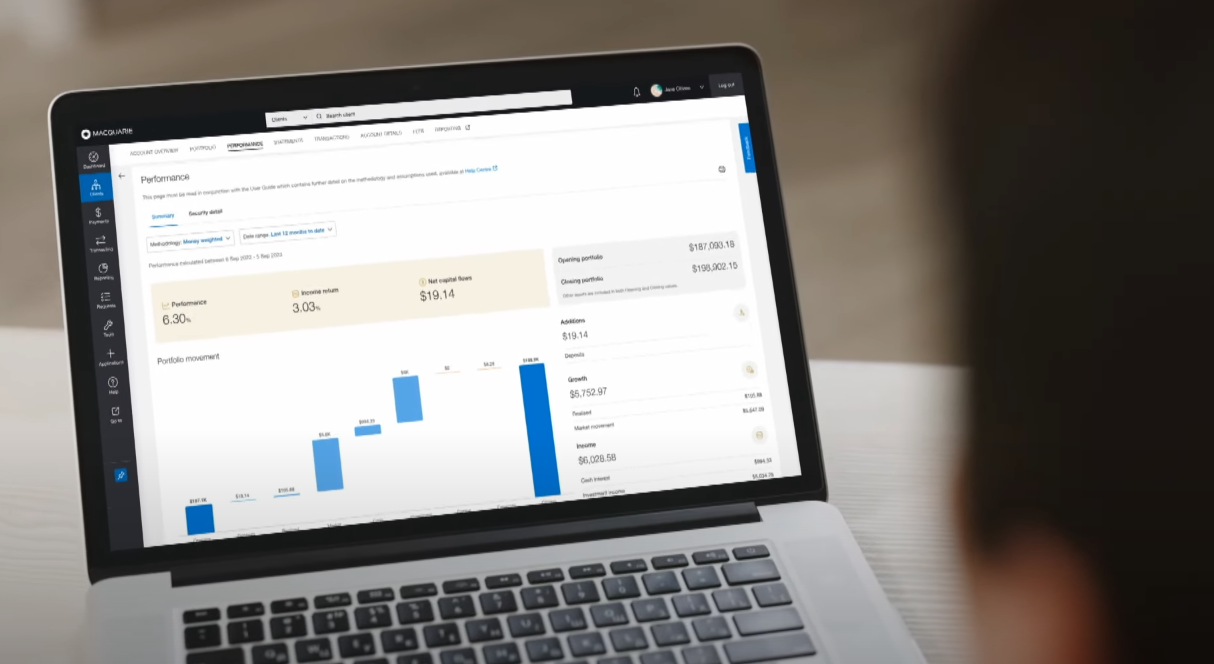

- Access insights and data to make smart investment recommendations and provide superior advice to your clients

We released the first set of exciting new performance reporting tools in Adviser Online, ensuring you have access to your clients’ information and reporting from one location. Watch the video below to learn more about the reporting capabilities we’re building.

Watch video

Loading video...

- Relevant and insightful information from our enhanced Adviser Online dashboard

We added the Funds Under Management (FUM), Advice Fee Consent (AFC) and Request Centre widgets so you can get the information you need, as soon as you log into Adviser Online.

- Quick access to your clients’ correspondence online

Over 60 different types of client correspondence are now available in Adviser Online, removing the need to contact us for a copy.

- Greater visibility of adviser and dealer details with My access in Adviser Online

We added a new page in Adviser Online called ‘My access’, which displays your level of access and all the adviser and dealer codes you have access to, as well as anyone else who has access to those codes. My access protects your clients and your business by giving you visibility over who has access, so you can control when this access needs to be updated or removed.

- Making Adviser Online the single platform where you can access all your clients’ information and reporting in one place

We’ve migrated tools such as Asset Allocation Benchmarking and Account Income Redirection from Wrap Online to Adviser Online to simplify your online experience. This means you can now:- track and report on your client portfolios’ market exposure with our enhanced Asset Allocation Benchmarking tile on the 'Account Overview’ screen in Adviser Online. This allows you to benefit from improved usability, toggle between pie and bar charts, and generate uplifted client-friendly asset allocation reports that will support end-of-year conversations.

- give your clients access to their income with Account Income Redirection by redirecting investment income (dividends, distributions, interest) from a Macquarie Wrap account to an external nominated account (rather than to a linked CMA), integrated with Authenticator for adviser approval if you’re a Wrap user with transact access.

Streamlining your tools and operations

- Easily view and customise SMAs in Adviser Online

As part of migrating tools from Wrap Online into Adviser Online, we recently enhanced the existing SMA customisations feature as part of its integration into Adviser Online so you can now view existing instructions to exclude listed securities and ETFs, managed investments and/or GICS sectors from being held within SMAs. Next, we’re focused on giving you the ability to customise SMAs directly within Adviser Online and will provide an update when this feature is available for users soon. - We've updated our Target Market Determinations (TMD)

We've recently updated the TMDs for our Cash Management Accounts, Term Deposits, IDPS, Super and Pension products. The TMDs describe the types of clients these products have been designed for, as well as any conditions that apply to the distribution of the products, and distributor reporting requirements.

The TMDs are reviewed annually, and we'll let you know each time new versions are made available online. You can access our TMDs via our Design and Distribution Obligations website to learn more about changes which may affect your clients.

Helping protect you, your business and clients during the festive season

At Macquarie, we have teams dedicated to understanding, monitoring, and responding to emerging scam threats and we’re sharing their insights to help keep you and your clients protected. We recommend reading the below to ensure you, your business and clients are protected this festive season.

- We’ll never ask you or your clients to transfer funds to another account

Impersonation scammers impersonate a bank or other service company by phone or SMS and ask you to authorise transactions, make a payment, or provide personal information. To prevent these scams, never share passwords with anyone, avoid using phone numbers or links from text messages and check contact information using a trusted source such as the company’s website. - Investment opportunities offering fast results and big returns can be an indication of a scam

Investment scams are often hard to spot, but we’ve provided a list of things to look out for:- unsolicited investment offers such as cryptocurrency, corporate or treasury bonds, and share IPOs (Initial Public Offerings), claiming to be from reputable businesses

- endorsement of an investment or other business opportunities from celebrities

- early access to superannuation with a fee.

- If it’s too good to be true, it probably is

Buying or selling on an online selling platform is great when it’s quick and hassle-free. But scammers are popping up everywhere, making it harder to navigate your online shopping experience. This festive season, we recommend avoiding buyers/sellers who:- don't have a profile photo

- offer a very attractive price

- ask you for your phone number or email

- overpay you for an item or,

- offer payment via a gift card or prepaid shipping.

If you’d like to learn more about different types of scams and tips to help protect yourself, visit our scams guide for more information.

Giving you more choice and flexibility

Access new assets added to our investment menu effective 1 December 2023

New Managed Funds | |

| APIR Code | Fund Name |

MAQ2153AU | Arrowstreet Global Small Companies Fund |

NML0018AU | Macquarie Cash Fund – Class M Units |

HOW3532AU | Apollo Aligned Alternatives Fund* |

New Wholesale Managed Funds (IM)* | |

APIR Code | Fund Name |

ETL6408AU | AIPX Global Investments Fund Schonfeld Class (IM) |

FFT0505AU | 442 Capital Emerging Companies Fund (IM) |

SPC3979AU | Edgeworth Global Fund A (Unhedged) Class (IM) |

Exchange Traded Products | |

ASX Code | Scheme Name |

H100 | BetaShares FTSE 100 Currency Hedged ETF |

GLDN | iShares Physical Gold ETF |

SKUK | Hejaz Sukuk Active ETF (Managed Fund) |

MHOT | VanEck Morningstar Wide Moat(AUD Hedged) ETF |

QHSM | VanEck MSCI Int SML Comp Qlt(AU Hdgd) ETF |

HVLU | VanEck MSCI Intl Value (AUD Hedged) ETF |

1GOV | VanEck 1-5 Year Australian Gov Bond ETF |

5GOV | VanEck 5-10 Year Australian Gov Bond ETF |

XGOV | VanEck 10+ Year Australian Gov Bond ETF |

CFLO | Betashares Global Cash Flow Kings ETF |

Seperately Managed Accounts (SMAs) | |

SMAVEN01S | IQ Portfolio Growth 30 |

SMAVEN02S | IQ Portfolio Growth 50 |

SMAVEN03S | IQ Portfolio Growth 70 |

SMAVEN04S | IQ Portfolio Growth 85 |

SMAVEN05S | IQ Portfolio Defensive 70 |

SMAVEN06S | IQ Portfolio Defensive 50 |

SMAVEN07S | IQ Portfolio Defensive 30 |

* IDPS only