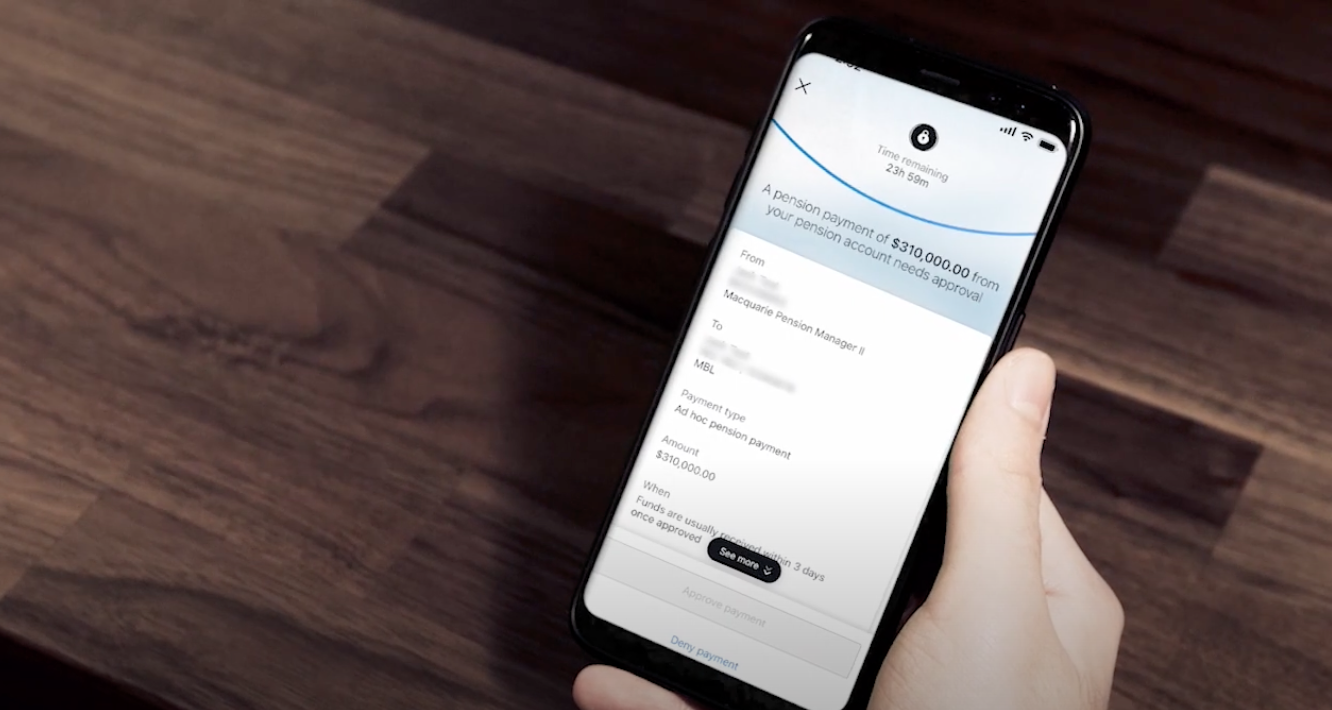

On behalf of your clients, you can initiate online lump sum withdrawals, rollovers and ad hoc pension payments for eligible pension accounts only (excludes Term Allocated Pensions and Transition to Retirement pensions).

Lump sum withdrawals and ad hoc pension payments will be one-off payments made independently of the existing payments your clients receive, and they won’t impact those arrangements. These payments will be paid out to your client’s nominated account.

Rollover payments can be paid to either a self-managed superannuation fund (SMSF) or an APRA-regulated superannuation fund.

Watch video

Loading video...